There are a couple reasons it is recommended to take a salary from your limited company. The first is that is accounted for as an allowable business expense. This means it lowers the amount of corporation tax you company has to pay. You will also want to take a salary if it is above the lower earning limit, currently £6240 annually for the 2021/22 tax year.

Should I take a high or low salary?

It is recommended that you pay yourself a small salary, to ensure you do not have to pay income tax or national insurance contributions. This means you will reap the benefits of qualifying for state pension.

As a limited company, you will receive a personal allowance threshold annually, this is the income you can receive before you need to pay income tax. The personal allowance has risen to £12,570 for the 2021/22 tax year. As long as your salary is within this budget you won’t need to pay any income tax.

Conversely, as much as it is advised to pay yourself a low salary, there are also disadvantages that can occur from paying yourself an extremely low salary, or not taking anything at all. An example is missing out on your personal tax free allowance, you could be missing out on the amount you can take before being tax free. Additionally, a loan or mortgage have specific criteria to fill, which cannot be met with a low salary/no income, unless you use a specialist mortgage broker.

Dividends

You can also pay yourself through your dividends. Dividends are profits accumulated by your company that is then distributed between your shareholders. This is efficient for tax purposes, as you are utilising your dividend allowance and won’t end up falling into the higher tax bracket. However, the 2021/22 tax year remains the same at £2,000 tax free dividend allowance. However, threshold amounts have changed in line with income tax.

- Basic rate taxpayers (20% tax rate) pay an additional 7.5% on dividends.

- Higher rate taxpayers in the 41% tax rate pay 32.5% on dividends.

- Additional rate taxpayers pay 38.1%

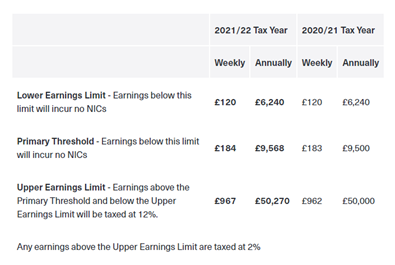

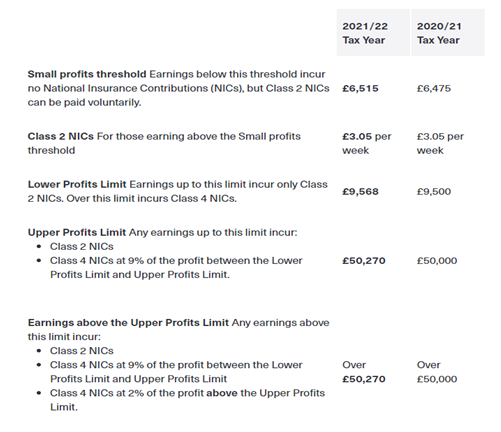

National Insurance Thresholds

You can make national insurance deductions on earnings above the lower earnings amount.

Table 1 shows the employee national insurance classifications in class 1

Table 2 shows the self-employed national insurance calculations

For more information on this blog or to speak to an expert, contact us !

One comment

Carlos

21/11/2021 at 8:46 pm

Very helpful. Thank you