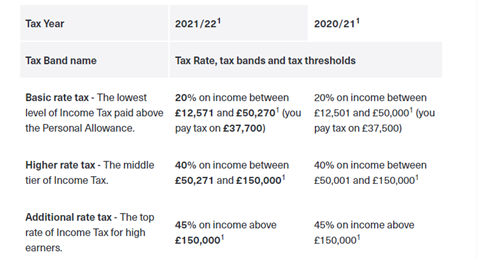

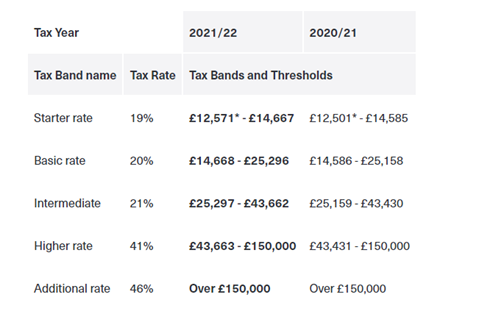

[cool-process category=”all” type=”with-number” show-posts=”2″ autoplay=”false” content=”summary” content-length=”” read-more-button=”yes” read-more-text=””]The new tax year 2021/2022 began on the 6th April 2021, and there has been a few changes that will affect businesses and individuals. The tables below show the previous and current changes to the UK tax rates and separately for Scotland.

(UK, excluding Scotland)

(Scotland)

Dividend Allowance

Dividend is the amount of profits by an organisation to their investors/shareholders. Any amounts undistributed is then re-invested into the business.

- The 2021/22 tax year remains the same at £2,000 tax free dividend allowance. However, threshold amounts have changed in line with income tax.

- Basic rate taxpayers (20% tax rate) pay an additional 7.5% on dividends.

- Higher rate taxpayers in the 41% tax rate pay 32.5% on dividends.

- Additional rate taxpayers pay 38.1%

Benefits in Kind

There were previous arrangements for changes to benefits in kind tax rates in the new 2021/22 tax year. After 5th April 2020 benefits to registered cars will be increased by 1%, However, there will be no increase to electric cars. Predictions show that by the 2022/23 tax year, there will be a 2% increase to benefits in kind on company cars.

Student loans

The department of education has confirmed that from 6th April 2021, there will be changes in the threshold earnings before you repay your student loan. This will apply to current and future student loans where the individual meets the threshold requirements. Therefore, it is important payroll providers are aware of the employees who make student loan repayments so there correct deductions can be made.

- Plan 1 loans will increase to £19,895 from £19,390

- Plan 2 loans will increase to £27,295 from £26,575

- Plan 4 loans which are being introduced for new and existing Scottish loans will be changed from their existing plan 1 to Plan 4.

Recovery Loan Scheme

The recovery loan scheme will provide lenders an 80% guarantee on eligible loans between £25,000 – £10million. The scheme is open to all businesses who have received support during the COVID-19 pandemic.

The coronavirus business interruption loan scheme (CBILS) will end as of 31st March 2021 before the new tax year.

Written by Abi Raji

For more information on this blog or to speak to an expert, contact us below!

One comment

Mark

09/09/2022 at 10:40 pm

Thanks for your blog, nice to read. Do not stop.